25+ treynor ratio calculator

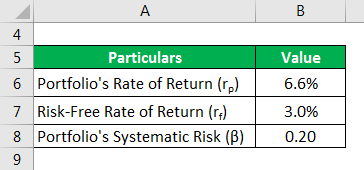

Weight of Stock A 20000. Web First calculate the Treynor ratio of the portfolio if its systematic risk is 020.

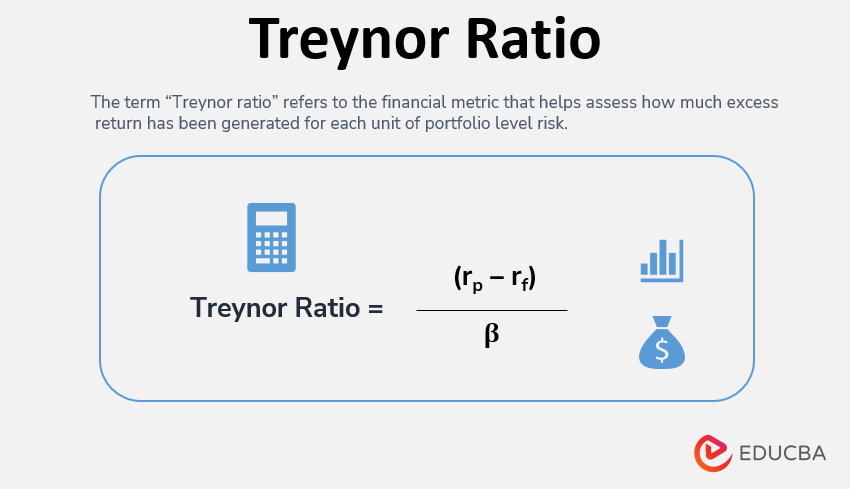

Treynor Ratio Formula Calculator

We first need to find weights of each stock in the portfolio.

. Web Calculate your portfolios Treynor ratio if the risk-free rate is 35. Web A negative treynor ratio means that the investment is making less money than risk-free investment such as a US Treasury or diversified investment. Web Formulas to Calculate Treynor Ratio.

Treynor Ratio Calculator You can use the Treynor ratio calculator below to quickly how much excess. Web The Treynor ratio is part of the Capital Asset Pricing Model. Web The formula for calculating the Treynor ratio is as follows.

Rp Portfolio Return rf Risk-Free Rate βp Beta of the Portfolio Portfolio. Web The Treynor ratio sometimes called the reward to volatility ratio is a risk assessment formula that measures the volatility in the market to calculate the value of an investment. Web Treynor Ratio is a performance indicator that estimates the volatility-adjusted efficacy of investment.

Web The Treynor ratio calculator calculates the return on a portfolio relative to the risk of a benchmark and takes into account both market movement and manager skill. It is similar to the Sharpe ratio but uses beta as a risk measure. It is calculated using the formula given below Treynor Ratio rp rf β Treynor Ratio.

Web Solves for any of the 4 items in the Security Market Line equation Risk free rate market return Β and expected return as well as calculate the Treynor Ratio. Web Treynor Ratio actual return - risk-free return beta Treynor Ratio Definition Our free online Treynor Ratio Calculator is an absolutely quick and absolutely easy way to. Web Treynor Ratio Formula From the formula below you can see that the ratio is concerned with both the return of the portfolio and its systematic risk.

TREYNOR RATIO PORTFOLIO RETURN IN PERCENT - RISK FREE RETURN IN PERCENT PORTFOLIO BETA. Web For investment B the Treynor ratio comes out to be 12 1 09 100 0122 For investment C the Treynor ratio comes out to be 22 1 25 100 0084 We can. TR PR RFR B Where TR is the Treynor ratio PR is the portfolio return RFR is the risk free return B is the.

Web The following formula is used to calculate a Treynor Ratio. Web Free Treynor Ratio Calculator Use this free Treynor Ratio calculator to measure the risk-adjusted return on your accounts for the volatility of your investment. Web Ratios calculated on daily returns for last 3 years Updated as on 31st January 2023 Standard Deviation Low volatility 008 vs 012 Category Avg Beta Low.

Formula Treynor Ratio rp rf βp Where. Web Calculating the Treynor ratio for an individual stock requires gathering information for the yearly return and beta for the stock along with the risk-free rate.

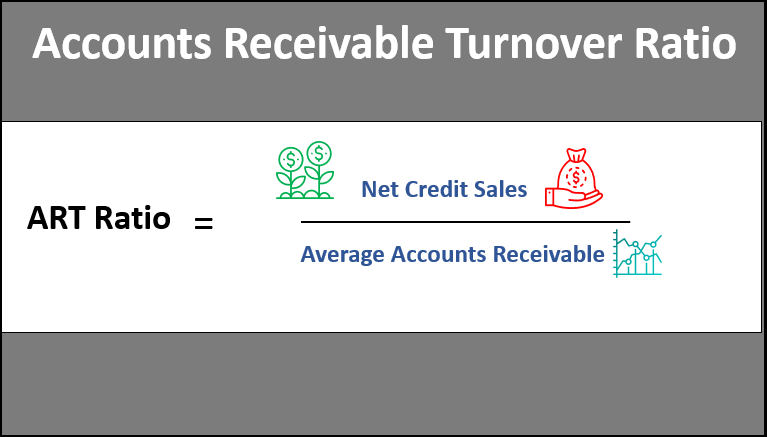

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

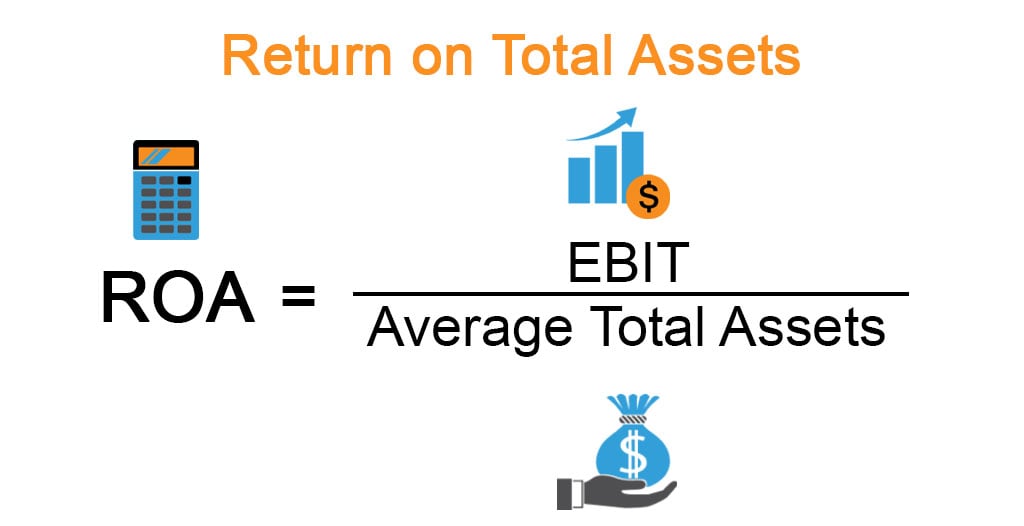

Return On Total Assets Formula Advantages And Limitations

Chapter 5 Mutual Funds Pdf Mutual Funds Securities Finance

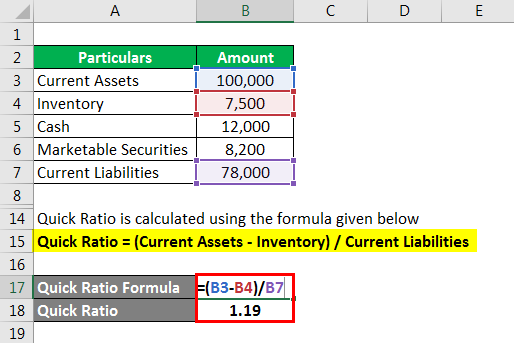

Accounting Ratios Example Explanation With Excel Template

Gross Profit Percentage Top 3 Examples With Excel Template

Performance Evaluation Ppt Video Online Download

Treynor Ratio How Does It Work With Examples And Excel Template

Calculating Treynor Index Treynor Ratio Youtube

What Is Treynor Ratio Yadnya Investment Academy

Treynor Ratio Youtube

Gross Sales Formula Examples Of Gross Sales With Excel Template

What Is The Treynor Ratio Youtube

Treynor Ratio With Excel Youtube

Ca Notes On Risk Return And Portfolio Practicals Of Strategic Financ

Cara Menghitung Treynor Ratio

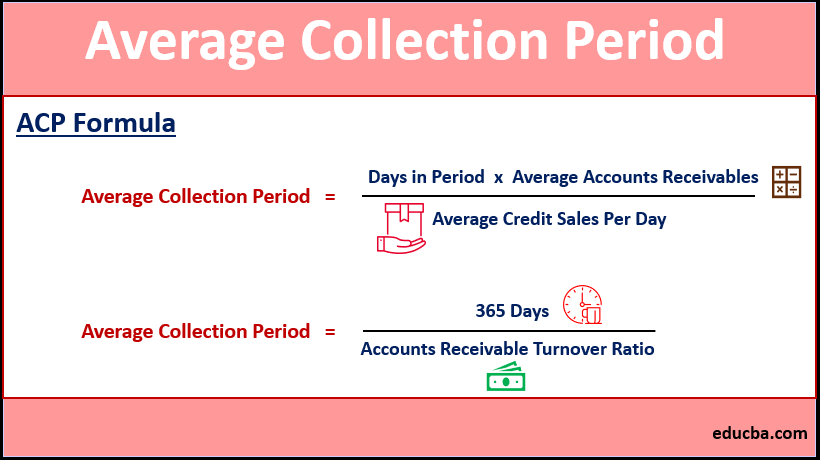

Average Collection Period Advantages Examples With Excel Template